Kakebo: The Japanese Money-Saving Method That’s Taking the World by Storm

In a world filled with complex budgeting apps and overwhelming financial advice, are you searching for a simpler, more intuitive way to manage your money? The answer might lie in a century-old Japanese tradition. The Kakebo method, a mindful and reflective approach to personal finance, is gaining global popularity for its simplicity and profound effectiveness. This is not just another budgeting spreadsheet; it is a philosophy that empowers you to understand your spending habits, save more effectively, and build a healthier relationship with your money. This article will provide you with a comprehensive guide to mastering the Kakebo system and taking firm control of your financial future.

This powerful tool goes beyond simply tracking numbers. It encourages you to think critically about your purchases, distinguishing between needs and wants, and aligning your spending with your long-term goals. If you are ready to stop wondering where your money goes each month and start directing it with purpose, the Kakebo method is the solution you have been looking for.

What is the Kakebo Philosophy?

At its heart, Kakebo (pronounced kah-keh-boh) translates to ‘household finance ledger’. It was created by Motoko Hani, Japan’s first female journalist, as a tool to empower women to manage their household budgets effectively. However, its principles are timeless and universally applicable. Unlike automated budgeting apps that can disconnect you from the reality of your spending, Kakebo is a hands-on, analog system that uses a physical journal to foster a deep awareness of your financial flows.

The core philosophy is built on the practice of mindful spending. By physically writing down every expense, you are forced to pause and acknowledge each transaction. This simple act interrupts impulsive buying habits and turns a mindless activity into a conscious decision. It is about understanding the ‘why’ behind your spending, not just the ‘what’ and ‘how much’. This reflective process is the key to transforming your financial behavior from reactive to proactive.

The Four Pillars of Kakebo

The Kakebo method revolves around a structured process of planning, tracking, and reflecting. At the beginning of each month, you will sit down with your journal and answer four fundamental questions. This ritual sets the stage for a month of conscious financial management.

- How much money do you have available? This is your starting point. Calculate your total income for the month and subtract all your fixed expenses, such as rent or mortgage, utilities, loan payments, and insurance. The result is your disposable income for the month.

- How much would you like to save? Before you spend a single dollar, decide on a realistic savings goal for the month. By setting this intention first, you prioritize saving rather than treating it as an afterthought. This amount is immediately set aside from your available funds.

- How much are you spending? This is the daily practice of Kakebo. You must diligently record every single expense, no matter how small. This meticulous tracking provides the raw data you need for the final, most crucial step.

- How can you improve? At the end of the month, compare your actual spending against your budget and savings goals. This is the moment of reflection. Analyze where you overspent, identify your spending triggers, and devise strategies to do better in the following month.

How to Start Your Own Kakebo Practice

Getting started with Kakebo requires nothing more than a simple notebook and a pen. The physical act of writing is a critical component of the method’s success, as it helps solidify the connection between your actions and their financial consequences. Begin by dedicating a new notebook to be your Kakebo journal.

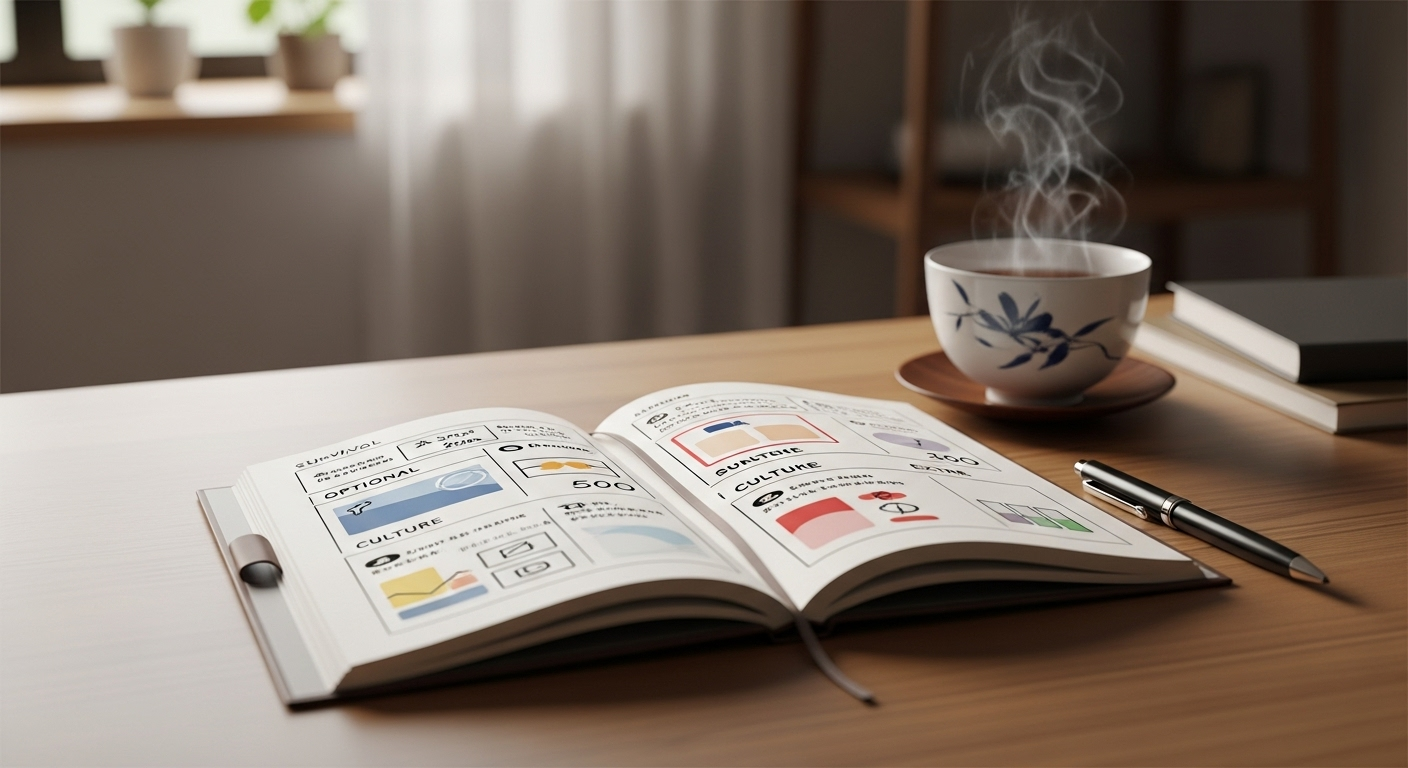

At the start of each week and month, track your spending by categorizing each purchase. Kakebo traditionally uses four main categories to help you understand the nature of your expenses:

- Survival: These are your absolute necessities. Think groceries, housing, transportation for work, and medical bills.

- Optional: This category covers your wants, not your needs. It includes things like dining out, shopping for non-essential items, and hobbies.

- Culture: Expenses related to personal enrichment, such as books, museum tickets, concerts, or streaming subscriptions.

- Extra: This is for unforeseen expenses, like emergency repairs, gifts, or one-off purchases that do not fit elsewhere.

By categorizing your spending this way, you gain crystal-clear insight into where your money is truly going. You might be surprised to see how much of your ‘Optional’ spending could be redirected toward your goals, such as building a robust savings account or funding an investment portfolio.

Beyond the Budget: The Benefits of Mindful Spending

The most significant advantage of the Kakebo method is the sense of control and calm it brings to your financial life. Financial anxiety often stems from a lack of clarity. By meticulously tracking your cash flow, you eliminate the unknown and replace it with concrete data. This knowledge is empowering and allows you to make decisions from a place of confidence, not fear.

This practice cultivates discipline and delayed gratification. When you have to write down that third coffee of the day, you are more likely to question if it is truly necessary. This consistent self-interrogation builds a powerful mental muscle that helps you resist impulse purchases and stay focused on what truly matters to you. Over time, Kakebo transforms from a budgeting tool into a way of life, promoting a more intentional and values-driven approach to consumption and personal finance.

Conclusion: Reclaim Your Financial Power

The Kakebo method is more than a way to save money; it is a journey of financial self-discovery. In its simplicity lies its power. By ditching complex apps and returning to the basics of pen and paper, you engage with your finances on a deeper, more meaningful level. It teaches you to be the master of your money, not its servant. By embracing the principles of mindful spending, consistent tracking, and honest reflection, you can build a sustainable financial future, reduce stress, and ensure your money is working to support the life you want to live.

Frequently Asked Questions (FAQ)

Is Kakebo suitable for people with irregular incomes?

Absolutely. While Kakebo is often explained using a monthly framework, it is highly adaptable. If you are a freelancer or have a variable income, you can adjust the planning cycle. Instead of planning for the whole month, create a plan every time you get paid. Calculate your available funds from that specific income, set aside a portion for savings, and budget the rest until your next paycheck. The core principles of tracking and reflection remain the same and are just as effective.

How is Kakebo different from a typical Western budget?

While both systems involve tracking income and expenses, the key difference is the emphasis on mindfulness and self-reflection. A typical budget often focuses strictly on the numbers, using apps to automate the process. Kakebo, on the other hand, is a manual, reflective practice. The goal is not just to stay within a budget but to understand your emotional relationship with money and to consciously improve your spending habits through introspection at the end of each month.