Interest Rate: What It Is and How It Affects Your Loans and Savings

The interest rate is one of the most fundamental concepts in personal finance, yet its full impact on our daily lives is often misunderstood. It is a number you see mentioned in the news, on bank statements, and in loan agreements, but what does it truly represent? Understanding the interest rate is not just for economists; it is crucial for anyone looking to manage their money effectively, whether you are applying for a mortgage, opening a savings account, or planning for retirement. This article will demystify the concept of interest rates, explaining what they are, the different types that exist, and how they directly influence your debts and your wealth.

By the end of this guide, you will have a clear understanding of how to navigate the financial landscape shaped by these powerful figures. You will learn how to make smarter decisions that can save you thousands on loans and help you maximize the returns on your savings. Let’s dive into the core of what makes your money grow or your debt cost more.

What Exactly Is an Interest Rate?

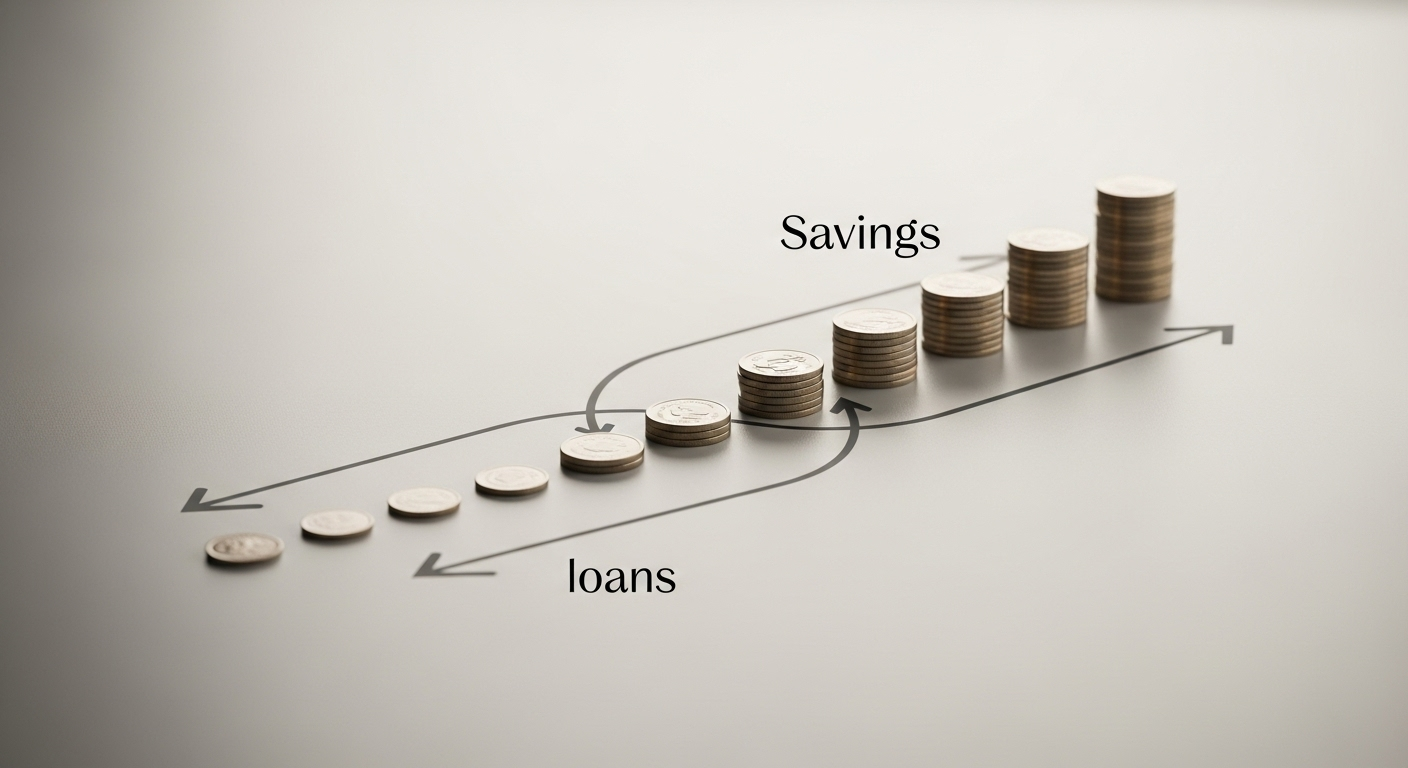

At its simplest, an interest rate is the price of money. It is the cost you pay for borrowing money and the compensation you receive for lending or saving it. Think of it like rent: when you rent an apartment, you pay the owner for the privilege of using their property. Similarly, when you take out a loan, you pay the lender interest for the privilege of using their money. Conversely, when you deposit money into a savings account, the bank pays you interest because it is effectively borrowing your money to lend to others.

This percentage is typically expressed as an annual rate. For example, if you borrow €1,000 at an annual interest rate of 5%, you would owe €50 in interest after one year, in addition to repaying the original €1,000. For savers, a €1,000 deposit in an account with a 2% annual interest rate would earn you €20 in a year. This dual nature makes the interest rate a critical factor in both building wealth and managing debt.

Key Types of Interest Rates You Need to Know

Not all interest rates are created equal. They come in various forms, and understanding the differences is essential for choosing the right financial products. Here are the most common types you will encounter:

- Fixed Interest Rate: As the name suggests, a fixed rate remains unchanged for the entire term of the loan or investment. This provides predictability and stability. Your monthly payments on a fixed-rate mortgage, for instance, will not change, making it easier to budget. The main advantage is security against rising rates, though the initial rate might be slightly higher than a variable option.

- Variable Interest Rate: A variable or floating rate can change over time, as it is tied to an underlying benchmark rate (like the Euribor). If the benchmark rate goes up, your interest payments will increase; if it goes down, you will pay less. This type of rate can be attractive when rates are expected to fall, but it carries the risk of unforeseen increases that could strain your budget.

- Simple Interest: This is calculated only on the principal amount of a loan or deposit. It is straightforward but less common for long-term products. For example, a €1,000 loan at 5% simple interest for 3 years would accrue €50 in interest each year, for a total of €150.

- Compound Interest: This is interest calculated on the initial principal, which also includes all of the accumulated interest from previous periods. It is often called interest on interest and is a powerful force for savers. For borrowers, however, it can cause debt to grow exponentially, especially with credit cards where unpaid balances are compounded daily or monthly.

How Interest Rates Affect Your Loans

The impact of interest rates on your loans is direct and significant. A higher rate means you pay more for the money you borrow, which translates into higher monthly payments and a greater total cost over the life of the loan. This applies to all forms of credit, from mortgages to credit cards.

Let’s consider a practical example. Imagine you are taking out a €200,000 mortgage for 30 years.

- At a 3% interest rate, your monthly payment would be approximately €843, and you would pay a total of €103,552 in interest over 30 years.

- At a 5% interest rate, your monthly payment would jump to approximately €1,074, and the total interest paid would be €186,512.

That 2% difference costs you over €83,000 more in the long run. This is why even a small change in interest rates can have a massive effect on your financial well-being. When considering new financial products or loans, always check the Annual Percentage Rate (APR), as it includes not just the interest but also other fees, giving you a more accurate picture of the total cost.

How Interest Rates Impact Your Savings and Investments

While high interest rates are a challenge for borrowers, they are a blessing for savers. When interest rates rise, the returns on your savings vehicles also increase. This means your money works harder for you, generating more passive income and helping you reach your financial goals faster.

Higher rates make savings accounts, certificates of deposit (CDs), and money market accounts more attractive, as they offer better yields with very little risk. For investors, the effect is more complex. Rising rates can make newly issued bonds more appealing than existing ones with lower yields, causing the market value of older bonds to drop. In the stock market, higher borrowing costs can squeeze corporate profits and slow economic growth, which may lead to stock market volatility. Therefore, a diversified investment strategy is key to navigating different interest rate environments.

The Role of Central Banks in Setting Rates

You might wonder who decides these all-important rates. The primary drivers are the world’s central banks, such as the European Central Bank (ECB) or the U.S. Federal Reserve. These institutions set a benchmark or policy rate, which influences the rates that commercial banks offer to their customers.

Central banks use interest rates as a tool to manage the economy. To combat high inflation, they raise interest rates to cool down spending and borrowing. This makes saving more attractive and borrowing more expensive, which helps to reduce the amount of money circulating in the economy. Conversely, to stimulate a sluggish economy, they lower interest rates to encourage borrowing and spending, boosting economic activity. Watching the decisions of central banks can provide valuable clues about the future direction of interest rates.

Conclusion: Taking Control of Your Financial Future

The interest rate is a fundamental pillar of personal and global finance. It dictates the cost of your debts and the growth of your savings, making it an inescapable part of your financial life. By understanding what it is, how it works, and who controls it, you empower yourself to make informed decisions. You can choose the right type of loan, refinance when the time is right, and optimize your savings strategy to align with the current economic climate.

Do not be a passive observer. Actively review your loans, savings accounts, and investments. Stay informed about economic trends and central bank policies. A little knowledge and proactive management can make a substantial difference in your ability to build wealth and achieve financial security. Your journey to mastering your finances starts with understanding these core concepts.

Frequently Asked Questions (FAQ)

What is the difference between the APR and the nominal interest rate?

The nominal interest rate is the base rate of interest for a loan, without accounting for any fees or the compounding of interest. The Annual Percentage Rate (APR), on the other hand, is a broader measure of the cost of borrowing. It includes the nominal interest rate plus any additional charges or fees, such as origination fees or closing costs. The APR is usually higher than the nominal rate and provides a more accurate, all-inclusive picture of what you will actually pay per year.

Should I choose a fixed or variable rate for my mortgage?

The choice between a fixed and variable rate depends on your risk tolerance and the current economic outlook. A fixed rate offers predictability and is ideal if you prefer stable monthly payments and believe that interest rates will rise in the future. A variable rate may start lower, offering initial savings, but it carries the risk that your payments could increase if benchmark rates go up. It may be suitable for those who can afford potential payment hikes or expect rates to fall.

How can I protect my savings from inflation when interest rates are low?

When interest rates on savings accounts are lower than the inflation rate, your money loses purchasing power over time. To protect your savings, consider diversifying your portfolio. While traditional savings accounts offer security, they may not keep pace with inflation. Explore other options such as investing in a diversified portfolio of stocks and bonds, real estate, or inflation-protected securities. It is often wise to consult with a qualified financial advisor to develop a strategy that aligns with your risk tolerance and long-term goals.