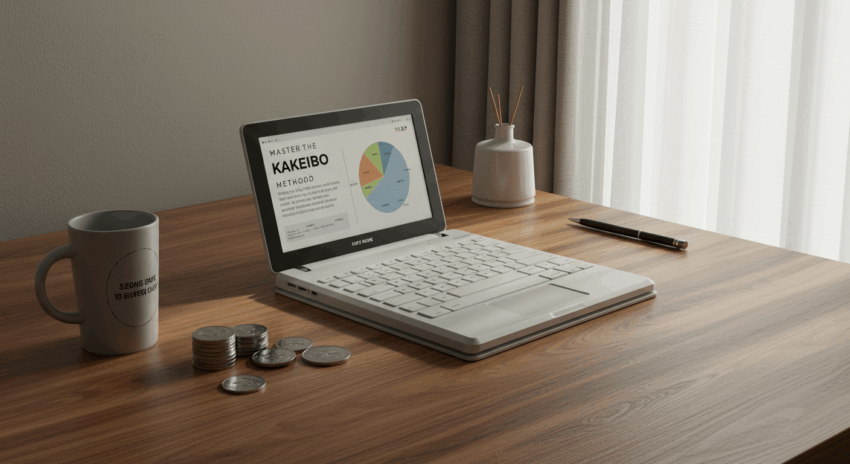

Are you looking for a way to save money that feels less like a chore and more like a mindful practice? The Kakeibo method, a century-old Japanese art of managing household finances, might be the perfect solution. Forget complex spreadsheets and automated apps for a moment. This approach brings you back to basics with pen and paper, encouraging a deeper understanding of your spending habits and fostering a healthier relationship with your money. This guide will walk you through everything you need to know to master this simple yet powerful system for financial well-being.

At its core, Kakeibo (pronounced kah-keh-boh) translates to household financial ledger. It was created in 1904 by Hani Motoko, Japan’s first female journalist, to empower women to manage their budgets effectively. More than just tracking expenses, Kakeibo is a philosophy. It prompts you to consciously think about your purchases, distinguishing between needs and wants, and reflecting on your spending to make better financial decisions in the future. The ultimate goal isn’t just to save more, but to spend better and more intentionally.

The Four Core Pillars of the Kakeibo Method

The Kakeibo system is built on a foundation of answering four key questions at the beginning of each month. This initial step sets the stage for a month of mindful spending and is crucial for the method’s success.

- How much income do you have? This is your starting point. Calculate your total take-home pay for the month after taxes and other deductions. If you have a variable income, use a conservative estimate based on previous months.

- How much do you want to save? Before you even think about spending, you decide on your savings goal. This simple act of prioritizing savings is a cornerstone of many successful savings strategies. It shifts the mindset from saving what’s leftover to making saving a planned, non-negotiable expense.

- How much are you spending? This is the ongoing part of the process. Throughout the month, you will diligently track every single expense, no matter how small.

- How can you improve? At the end of the month, you’ll review your spending, compare it to your goals, and reflect. This final question is what transforms Kakeibo from a simple ledger into a powerful tool for behavioral change.

Categorizing Your Expenses: The Kakeibo Way

Unlike some budgeting systems that have dozens of categories, Kakeibo simplifies things by grouping all spending into four main buckets. This structure helps you quickly see where your money is going and evaluate the value of your purchases.

- Survival: This category is for your absolute necessities—the things you need to live.

- Examples: Rent or mortgage, groceries, utilities (water, electricity), transportation to work, and essential medical expenses.

- Optional: These are your wants. They aren’t essential for survival but contribute to your lifestyle and enjoyment. This is often the first area to look at when trying to increase savings.

- Examples: Dining out, shopping for non-essential clothes, subscriptions like streaming services, hobbies, and entertainment.

- Culture: This category is dedicated to expenses that enrich your mind and spirit. The Japanese culture places a high value on personal development, and Kakeibo reflects this.

- Examples: Buying books, visiting museums, attending concerts or plays, taking a class, or a subscription to an educational magazine.

- Extra: This is for unexpected or non-recurring expenses. While some of these are unavoidable, tracking them helps you plan better for the future, perhaps by building a more robust emergency fund.

- Examples: A gift for a wedding, a home or car repair, or an unexpected medical bill.

Putting It All Into Practice: A Step-by-Step Guide

Ready to start your own Kakeibo journey? All you need is a notebook (a dedicated Kakeibo journal or any blank notebook will do) and a pen. Here’s how to implement the system on a weekly and monthly basis.

At the Start of the Month

Open your notebook to a new page. Write down your total monthly income. Next, subtract your fixed expenses (like rent and utilities). Then, decide on your savings goal for the month and write it down. The amount remaining is your spending money for the month. You can even divide this by the number of weeks in the month to get a weekly spending target.

Throughout the Month

This is where discipline comes in. Record every single purchase. Whether it’s your morning coffee, a bus ticket, or your weekly grocery run, write it down immediately and place it into one of the four categories (Survival, Optional, Culture, Extra). Many find it helpful to carry their notebook with them or to set aside five minutes each evening to log the day’s expenses. This manual act of writing forces you to acknowledge each time money leaves your wallet.

At the End of the Month

This is the moment of reflection. Tally up the total spending in each of the four categories. Then, answer the big question: How did your actual spending compare to your plan? Did you meet your savings goal? Now, reflect on the final Kakeibo question: How can you improve?

Look at your “Optional” category. Were there any purchases you regret? Could you have found a cheaper alternative? This isn’t about guilt; it’s about awareness. This monthly review is a critical learning process that helps you refine your budget and spending habits for the next month, aligning them more closely with your long-term finance goals.

Why the Kakeibo Method Works in a Digital World

In an age of automated budgeting apps and tap-to-pay convenience, the idea of using a physical notebook can seem outdated. However, the manual nature of Kakeibo is its greatest strength. It forces you to slow down and be present with your financial decisions. Automation can sometimes lead to a disconnect from our spending, but writing things down builds a strong mental connection.

The Kakeibo method promotes mindful spending over restrictive budgeting. It’s not about cutting out all fun; it’s about making conscious choices. By understanding where your money truly goes, you gain control and can direct it toward the things that matter most to you, whether that’s getting out of debt, saving for a big trip, or building a secure future. It’s a foundational skill that impacts the broader economy of your personal life.

Disclaimer: This article provides information for educational purposes only and is not intended as financial or investment advice. The Kakeibo method is a budgeting technique to help manage personal finances. Please consult with a qualified financial professional for personalized advice.

Frequently Asked Questions (FAQ)

Do I have to use a physical notebook for Kakeibo?

While the traditional Kakeibo method relies on a physical notebook to promote mindfulness, you can adapt it to modern tools. The key is to maintain the manual entry process. You could use a simple spreadsheet or a notes app on your phone. The important part is that you are actively recording and categorizing each expense yourself, rather than relying on an app to automatically pull and categorize transactions for you.

Is the Kakeibo method suitable for someone with an irregular income?

Yes, Kakeibo can be very effective for managing an irregular income. At the beginning of the month, you can set your budget based on your lowest anticipated income. When you receive more, you can make a conscious decision about where to allocate the extra funds—put more towards your savings goal, pay down debt, or assign it to a specific spending category. The monthly reflection process is especially valuable, as it helps you understand your spending patterns during both lean and abundant months.